The Perfect Payroll Management System is a sophisticated software solution designed to streamline the complex and time-consuming tasks of payroll processing for businesses of all sizes. With its advanced automation features, the system efficiently manages employee salaries, wages, bonuses, and deductions while ensuring compliance with tax laws and employment regulations. By simplifying the intricacies of payroll calculations and reducing the potential for human error, the Perfect Payroll Management System not only enhances the accuracy of financial operations but also improves the overall efficiency of the HR department.

This software helps businesses maintain precise records, generate detailed reports, and provide timely payments, thus boosting employee satisfaction and enabling HR professionals to focus more on strategic goals rather than administrative duties.

Key Features

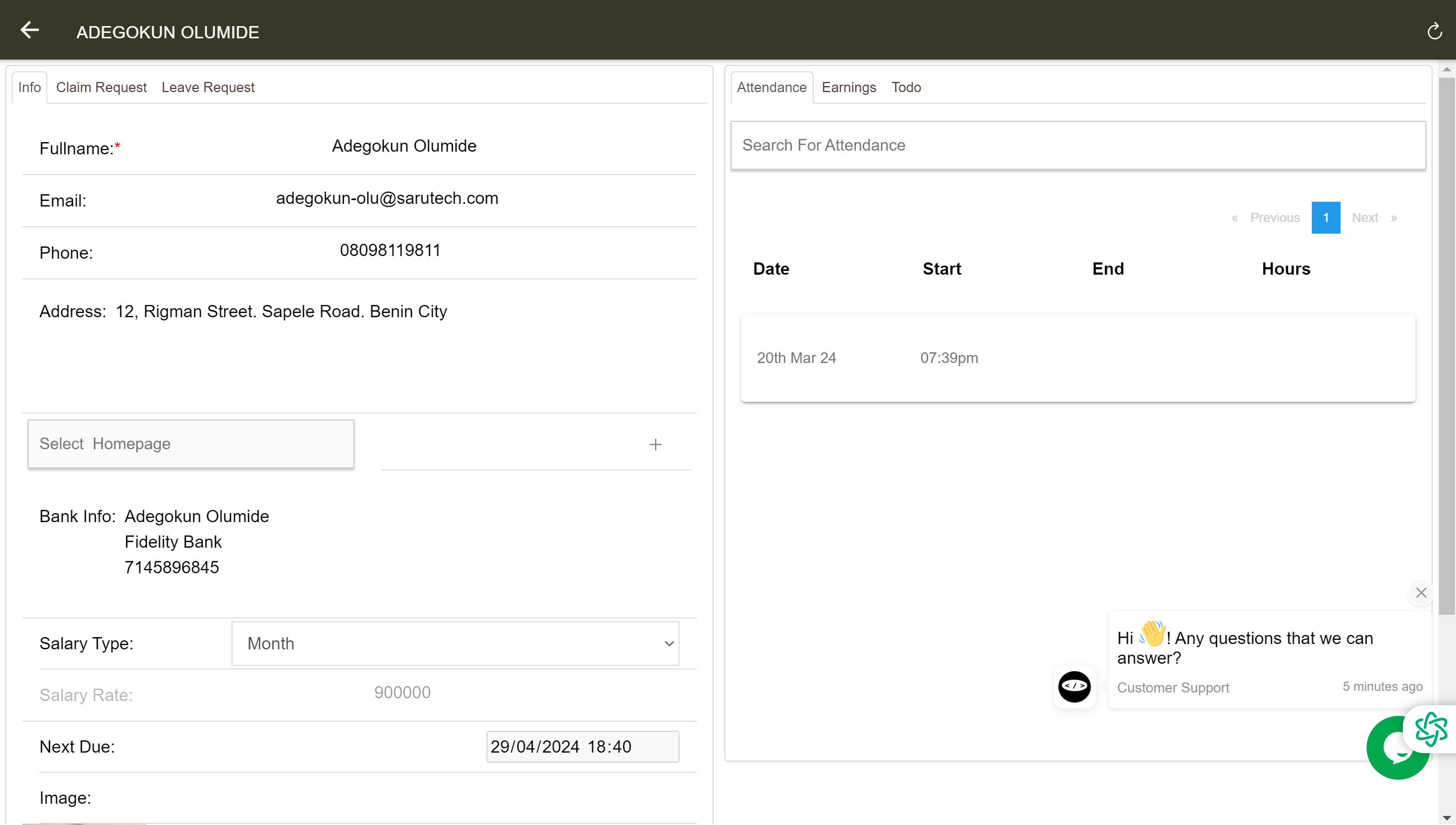

1. Simplified Employee Onboarding

Enable a smooth, comprehensive enrollment process, capturing all necessary employee details efficiently.

Why it's needed: Sarah, an HR manager, finds herself buried in paperwork every time a new employee joins. The manual onboarding process is not only tedious but also prone to errors. A simplified, digital employee onboarding system is crucial to save time and ensure accuracy.

Our System:

- Quick Enrollment: Enables HR managers like Sarah to swiftly onboard new employees, capturing all necessary details without the paperwork.

- Digital Document Management: Allows for digital submission and storage of important documents, ensuring easy retrieval and compliance.

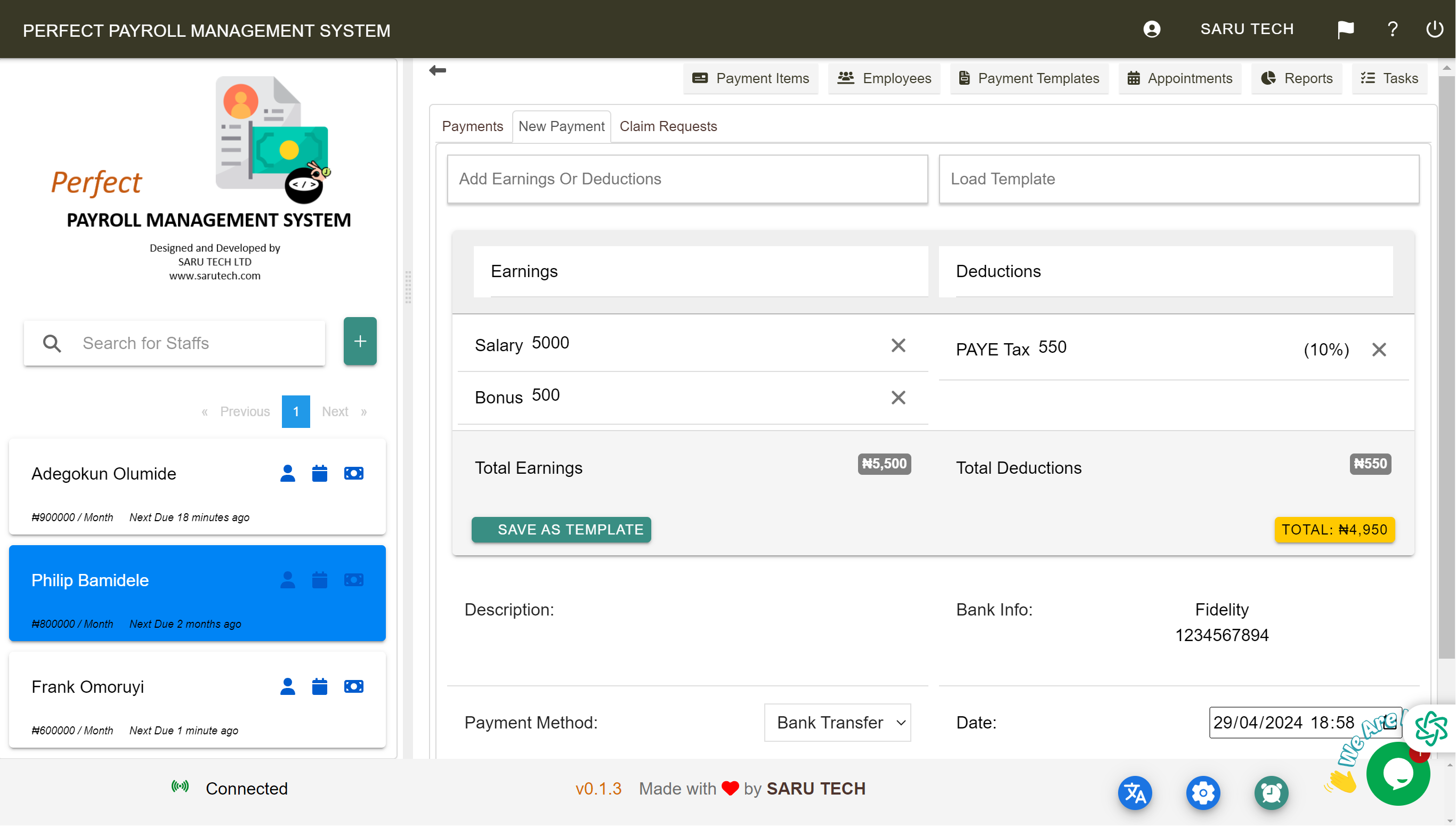

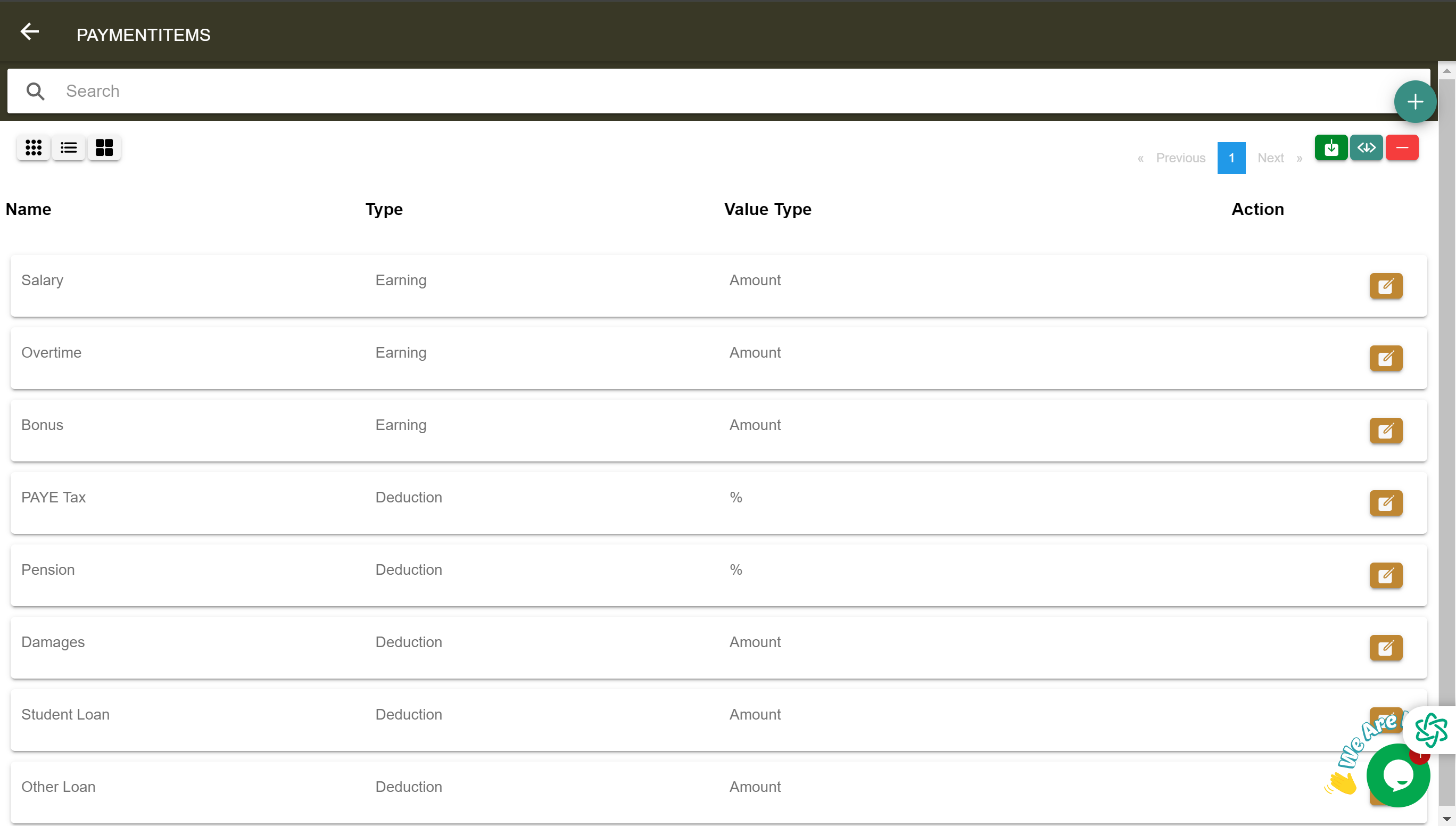

2. Custom Salary Components for Employees

Allow customization of various salary components in alignment with organizational policies, ensuring accurate and fair compensation.

Why it's needed: John, a finance manager, struggles with managing various salary components and ensuring they align with the company’s policies and legal compliance. A system that allows for customization of salary components is vital to manage employee compensation effectively.

Our System:

- Flexible Salary Components: Enables finance managers like John to customize salary components, ensuring they align with organizational policies and legal standards.

- Automated Calculations: Ensures that salary calculations are accurate and compliant, reducing the risk of errors and legal issues.

3. Single Click Payroll Runs

Automate various payroll activities with a single click, ensuring accuracy in computations and compliance with tax laws.

Why it's needed: Linda, a payroll specialist, spends hours manually calculating and processing payroll, a task that is not only time-consuming but also susceptible to human error. A single-click payroll run feature is essential to automate calculations, save time, and enhance accuracy.

Our System:

- Automated Payroll Processing: Enables payroll specialists like Linda to process payroll with a single click, ensuring efficiency and accuracy.

- Compliance Checks: Automatically checks payroll computations for compliance with tax laws, ensuring legal adherence without the manual checks.

Our System:

- Secure Online Transfers: Enables business owners like Robert to transfer salaries securely and promptly, maintaining trust and morale among employees.

- Collaboration with Banks: Ensures that the salary transfer process is smooth and reliable, providing consistency in payment schedules.

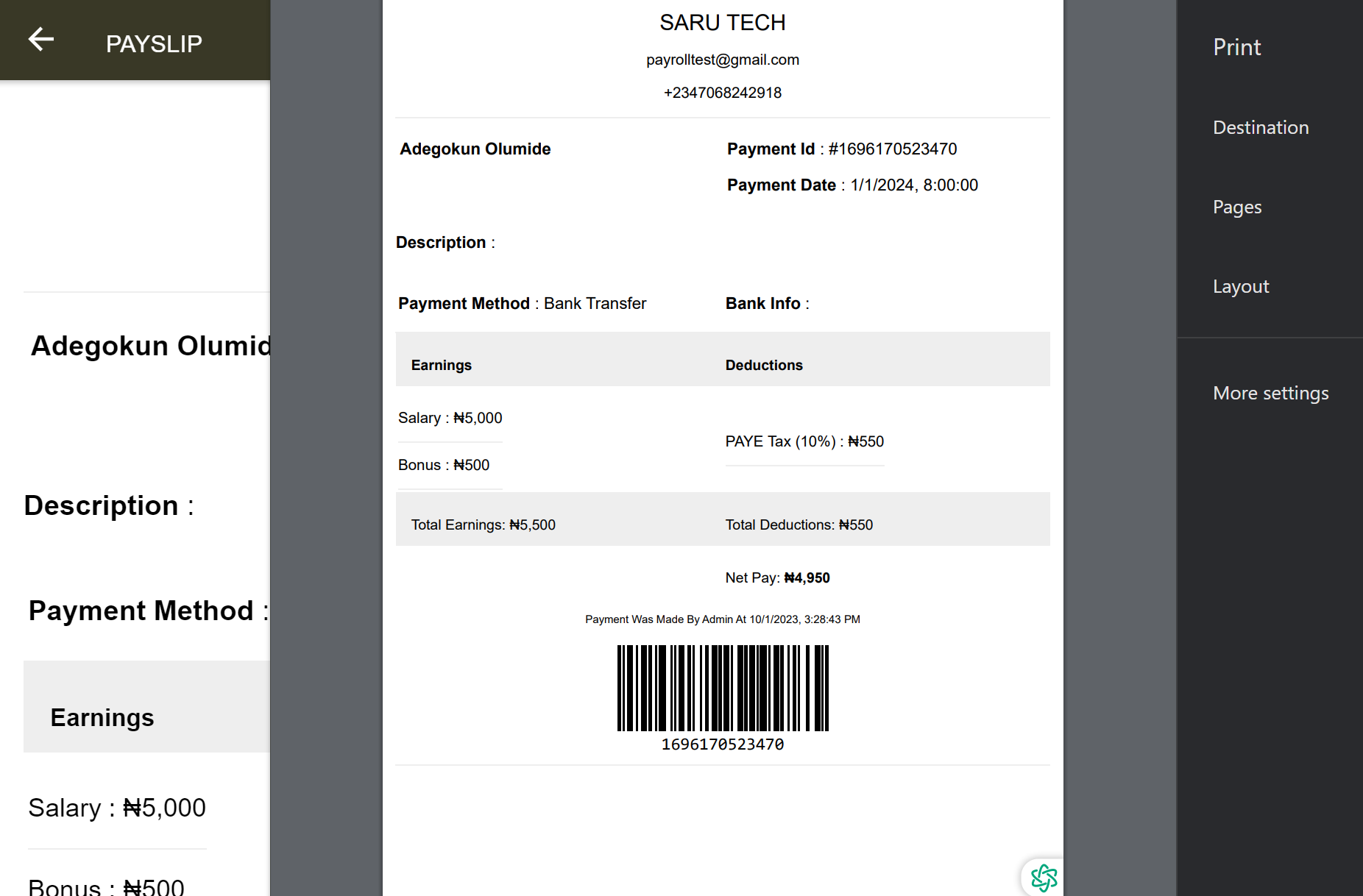

4. Employee Self-Service

Provide a digital portal for employees to manage their payslips, tax documents, and other payroll-related activities, ensuring transparency and accessibility.

Why it's needed: Meet Emily, who struggles to manage and access her payroll information, often having to go through HR for payslips and tax documents. An employee self-service portal is essential to empower employees like Emily, providing them with direct access to their payroll information and reducing the workload on HR.

Our System:

- Direct Access to Payslips: Enables employees to access and manage their payslips directly, ensuring transparency and independence.

- Manage Tax Documents: Allows employees to access and manage their tax documents, ensuring that they can easily adhere to tax filing requirements.

5. Leave and Attendance Management

Facilitate easy management of employee leave and attendance data through seamless integrations or data inputs, ensuring accurate payroll processing.

Why it's needed: Consider the case of Alan, an HR manager, who struggles with managing leave and attendance data, often resulting in discrepancies in payroll. A system that seamlessly manages leave and attendance data is crucial to ensure accurate payroll processing and maintain employee satisfaction.

Our System:

- Automated Leave Management: Enables HR managers like Alan to easily manage leave data, ensuring that it is accurately reflected in payroll processing.

- Attendance Tracking: Ensures that attendance data is accurately tracked and reflected in payroll, maintaining fairness and accuracy in salary computations.

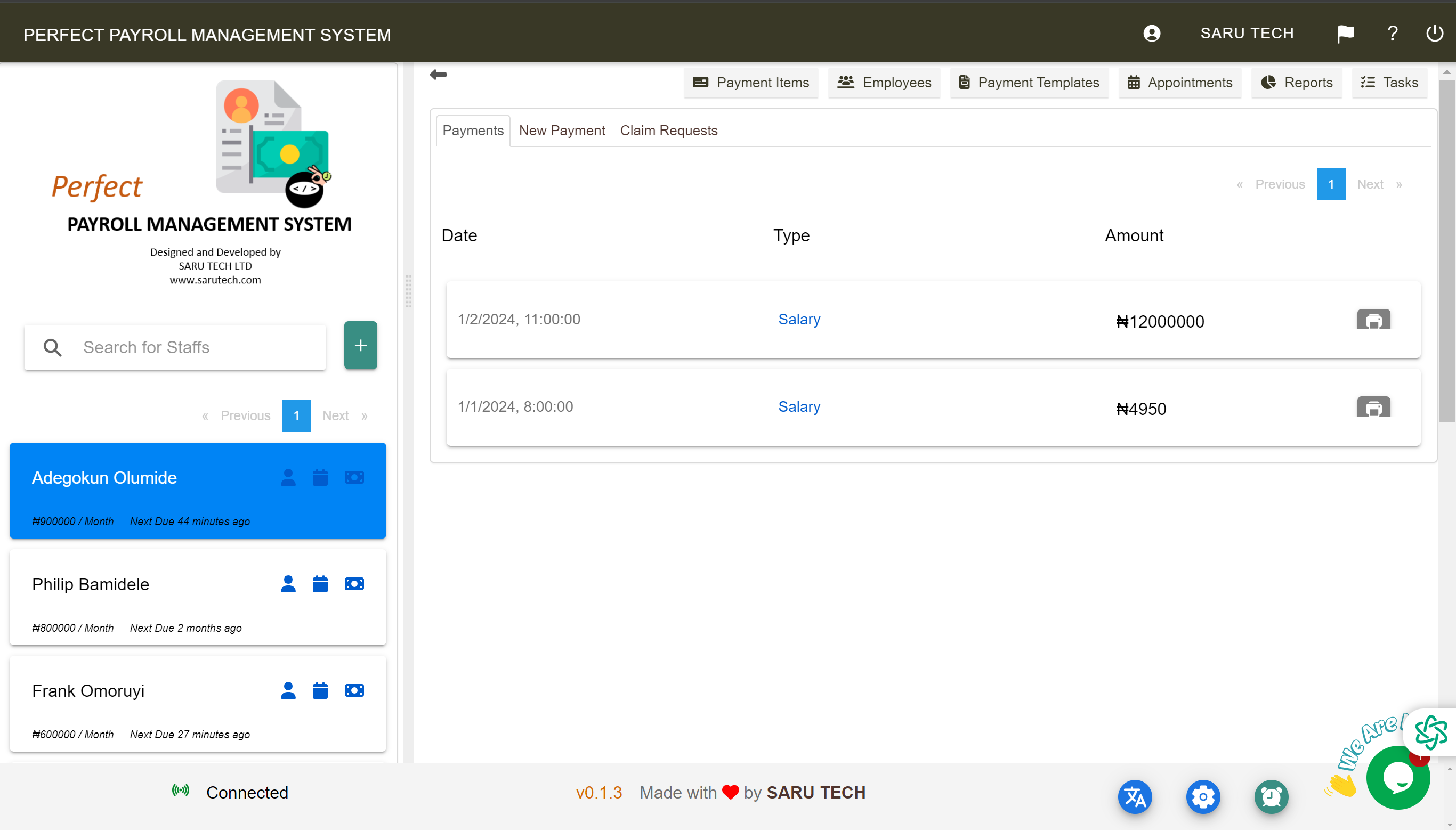

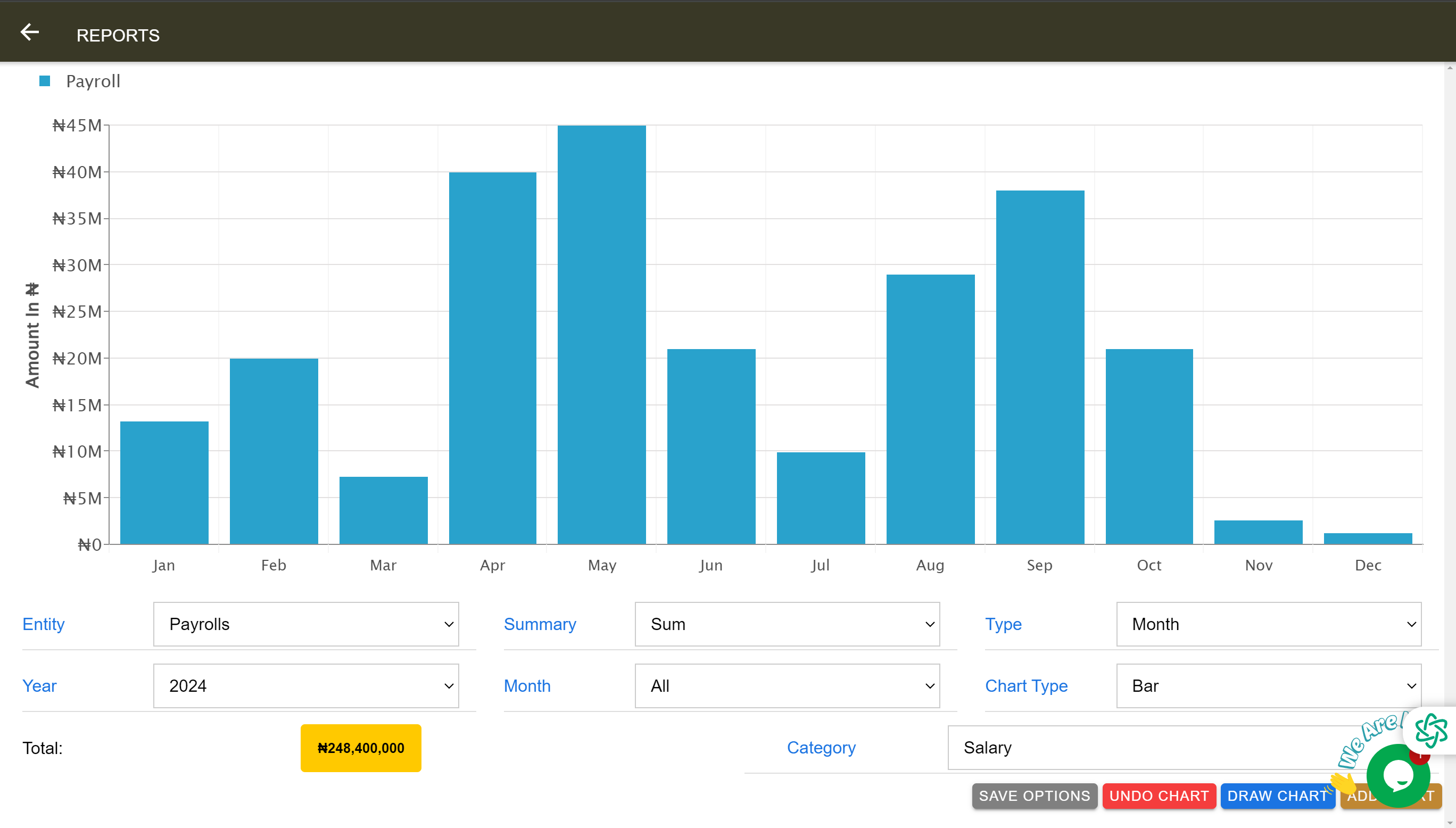

6. Comprehensive Audit Trails and Reporting

Keep detailed records of all payroll activities, ensuring transparency, accountability, and facilitating audits.

Why it's needed: Consider the scenario of Mike, an auditor, who struggles to trace payroll activities due to lack of comprehensive records, making the audit process tedious and challenging. A system that maintains detailed audit trails is crucial to ensure transparency, accountability, and facilitate smooth audit processes.

Our System:

- Detailed Activity Logs: Provides auditors like Mike with detailed logs of all payroll activities, ensuring that all actions can be traced and verified.

- Secure Data Storage: Ensures that all payroll data and activity logs are securely stored, maintaining data integrity and security.